Recovery in the market for mineral products like aggregates, concrete, asphalt and mortar was sustained during the fourth quarter of 2020, but full-year sales volumes were down on 2019.

This is according to the latest survey from the Mineral Products Association, which said the figures are encouraging but also urged the Government to push on with delivering the UK’s planned infrastructure programme to support the economic recovery, construction and the supply chain.

Following on from the faster than expected pickup in demand for these materials after the first Covid-19 lockdown, sales volumes of ready-mixed concrete increased by a 9.1% in 2020Q4 compared to the previous quarter, 7.8% for primary aggregates (crushed rock and sand & gravel), 5.5% for asphalt and 3.1% for mortar. Increases were recorded in most regions and devolved nations in Great Britain, except in London, where volumes of ready-mixed concrete and asphalt saw renewed declines in demand.

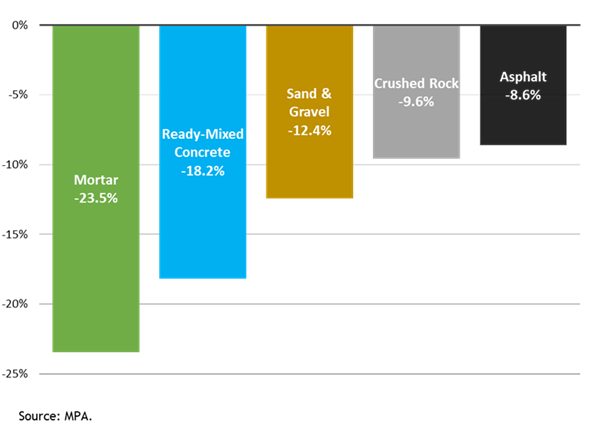

This means that for the whole year, sales volumes were significantly lower in 2020 compared to 2019, with ready-mixed concrete and mortar the weakest, down 18.2% and 23.5% respectively, while aggregates declined by 10.5% and asphalt by 8.6%.

Figure 1. Mineral products sales volumes in Great Britain, 2020 compared to 2019

The uneven market impact of the pandemic reflects sector-specific issues within construction, notably for those that are more exposed to general consumer and business confidence, such as for housing and commercial constructions.

Asphalt and aggregates sales were supported to a limited degree by continuity in road activity and some large infrastructure projects during the first lockdown, which was then followed by an acceleration during the second half of the year. As a result, on a quarterly basis, asphalt sales in 2020Q4 exceeded pre-pandemic levels, up 5.8% compared to 2019Q4. Similarly, aggregates sales were also back to pre-pandemic levels.

By contrast, the recovery in both ready-mixed concrete and mortar sales has been slower, and volumes in 2020Q4 remained lower compared with 2019Q4. Demand for these markets fell more significantly during the first lockdown, as housebuilding and commercial construction sites were mostly shut during the initial stages of the pandemic. Housebuilding saw a rapid subsequent recovery, fuelled by pent up demand on existing and completion of sites rather than the start of new projects, providing only a limited boost to mortar sales.

The recovery in ready-mixed concrete sales is slowed by compounding weaknesses in commercial construction, including for retail, offices, hotels and other leisure facilities. Output in the commercial sector was already declining before the pandemic due to Brexit-related economic and political uncertainty, which reduced confidence and investment in the sector. Widespread business closures due to the pandemic in the retail and hospitality sectors, alongside longer-term uncertainties on consumer habits and an accelerated move to online retail, as well as the potential for more ‘working from home’, are weighing on the sector’s outlook.

Looking forward, Aurelie Delannoy, Director of Economic Affairs at the MPA, warned that despite the encouraging rebound in demand for mineral products markets, the industry remains very cautious. “Sales volumes should continue to grow over 2021 and 2022, supported by the recovery of pandemic-related losses across all sub-sectors of construction, and robust growth in new infrastructure work, including on HS2. However, this outlook is beset with downside risks, not least due to the unknown future path of the pandemic and its potential wide-ranging impact on the UK economy and construction sector.

“As part of Government’s strategy to support the economy, the policy response so far has included an emphasis on infrastructure investment, including the announcement at the Spending Review 2020 of a new Levelling Up Fund for local infrastructure projects. This is is supported by the anticipated delivery of various five-year investment programmes in roads, rail and water and sewerage. However, infrastructure delivery is notoriously plagued by project delays and overrunning costs; further unmet expectations in this area would not only be a clear setback for the recovery in construction and mineral products markets, but also significantly impact on business confidence and investment throughout the supply chain in an already challenging economic environment.”

Nigel Jackson, CEO at MPA, added: “While it is encouraging to see the sector recovering, there may be tough times ahead. The key thing is to get on with delivery of the planned infrastructure programme, turning lofty ambitions into concrete reality. We need to make the link between those ambitions and the supply chain for them, building on Government’s recognition of our sector’s essential status which we have welcomed and is vital to help keep the economy moving.

“2020 was the most challenging year any of us can recall, and recovering from it will continue to take time. With cashflow challenges and project uncertainty, business needs continuing support and confidence boosting measures to encourage investment.”

Table 1. Mineral products sales volumes in Great Britain, change on the previous period (seasonally adjusted)

|

|

Asphalt

|

RMC(1)

|

Crushed Rock

|

Sand & Gravel

|

Mortar

|

Construction Output

|

|

2019

|

-0.8%

|

-3.9%

|

-0.7%

|

-5.4%

|

-2.3%

|

1.8%

|

|

2020

|

-8.6%

|

-18.2%

|

-9.6%

|

-12.4%

|

-23.5%

|

na

|

|

2020Q1

|

-9.4%

|

-5.7%

|

-4.2%

|

-3.7%

|

-1.6%

|

-2.1%

|

|

2020Q2

|

-28.3%

|

-40.0%

|

-37.6%

|

-39.4%

|

-63.0%

|

-32.7%

|

|

2020Q3

|

54.4%

|

52.0%

|

56.1%

|

56.6%

|

155.3%

|

41.2%

|

|

2020Q4

|

5.5%

|

9.1%

|

7.3%

|

9.1%

|

3.1%

|

na

|

Notes: (1) RMC is the sum of sales from both fixed and site plants.

Source: MPA, ONS

Ends.