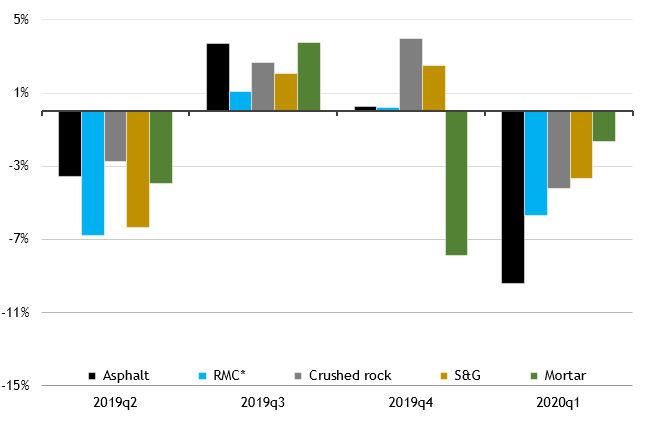

Construction market demand for heavy side building materials in Great Britain, including aggregates, asphalt, ready-mixed concrete and mortar, declined significantly at the start of 2020. The fall reflected a ‘double-whammy’ of flooding and adverse weather affecting work on site in February, and the early impact of the COVID-19 lockdown at the end of March. Combined, these two factors brought any early signs of market sales improvements recorded in the second half of last year to a halt.

Sales volumes of ready-mixed concrete and aggregates (crushed rock and sand & gravel), two materials that are used across most types of construction work, declined by 5.7% and 4.0% respectively over the quarter. For ready-mixed concrete, this follows three consecutive years of market declines since 2017, as Brexit-related uncertainties put a brake on commercial construction work, notably for offices, whilst housebuilding slowed in the capital. Housing and the commercial sectors have also been significantly impacted by the COVID-19 lockdown, with most major housebuilders having closed sites throughout the last week of March and April, and office construction impacted by the collapse in business and consumer confidence.

Simultaneously, mortar sales, which are primarily used in housebuilding, fell by a further 1.6% in the first quarter of 2020, after a 7.9% fall at the end of last year. The trend in mortar sales volumes has been subdued over the past 18 months, a clear indication of the underlying weaknesses in housebuilding even before accounting for the impact of the COVID-19 lockdown.

In roads, weak demand for asphalt led to a 9.4% fall in sales volumes in the first quarter of 2020 compared to the previous quarter, the biggest quarterly fall since mid-2012. Demand in Scotland and the South West was particularly affected. In Scotland, the market has been depressed since the highs recorded in 2016, when sales were boosted by large infrastructure projects, including the Forth Replacement Crossing and the Aberdeen Western Peripheral Route. In the South West, surfacing works were particularly hit by exceptional rainfall throughout February.

‘Weak underlying market demand for heavy-side building materials at the start of the year, combined with construction sites closures, are having a significant impact on mineral products businesses with an even weaker and more uncertain outlook for the rest of 2020’ explains Aurelie Delannoy, MPA Director Economic Affairs. ‘Since March, demand for ready-mixed concrete declined significantly as a result of widespread closures of housebuilding and commercial construction sites, as well as some early hiatus in major infrastructure projects, including Thames Tideway. By contrast, asphalt demand was somewhat supported by Highways England to supply the critical road network.’

throughout the supply chain and mineral products is no exception. However, with the prospects of construction and other sites gradually resuming work, mineral products producers are now focussing efforts on reopening their sites safely, bringing back staff and managing operations and work under strict safety guidance. The industry stands ready, able and willing to supply the materials needed for construction work to restart wherever it is safe to do so.’

‘Inevitably, large mineral products producers and SMEs alike have had to temporarily close operational sites throughout April, leading to an estimated 80-90% capacity shutdown across the industry due to construction and manufacturing customers closing down. Inevitably there are high levels of furloughing throughout the supply chain and mineral products is no exception. However, with the prospects of construction and other sites gradually resuming work, mineral products producers are now focussing efforts on reopening their sites safely, bringing back staff and managing operations and work under strict safety guidance. The industry stands ready, able and willing to supply the materials needed for construction work to restart wherever it is safe to do so.’

MPA CEO Nigel Jackson comments ‘It has been as torrid a time as any of us can remember. Just as optimism was increasing with Brexit uncertainty lifting, the combination of flooding and COVID-19 has knocked the economy for six. We are down to around 10 to 20% of normal capacity but still supplying strategic and essential sites as well as agriculture, utilities and local road maintenance. The industry has the material to supply as and when construction and manufacturing customers re-open knowing it can extract, process, manufacture and deliver safely if customers have new and safer working systems in place.

‘We were pleased to be recognised as essential by Government, and our members are ready to support the recovery and kick start the economy. We hope that Government will maintain a ‘can do’ approach to investment and invest in much needed and overdue infrastructure and that HS2 having been given the green light will not be frustrated by mischievous legal interventions at this critical time for our country. Government has to recognise the risks all future infrastructure projects could now face from legal action and pull harder on the national need lever to protect a return to growth and to protect jobs.’

Table 1. Building materials sales volumes in GB, percentage change on previous period (seasonally adjusted)

| |

Asphalt |

RMC(1) |

Crushed Rock |

Sand & Gravel |

Mortar |

ONS Construction Output |

| 2018 |

0.7% |

-1.6% |

2.5% |

1.3% |

15.6% |

0.0% |

| 2019 |

-0.8% |

-3.9% |

-0.7% |

-5.4% |

-2.3% |

2.3% |

| 2019Q2 |

-3.5% |

-6.8% |

-2.7% |

-6.4% |

-4.0% |

-1.2% |

| 2019Q3 |

3.7% |

1.1% |

2.7% |

2.1% |

3.7% |

0.9% |

| 2019Q4 |

0.3% |

0.2% |

4.0% |

2.5% |

-7.9% |

-0.1% |

| 2020Q1 |

-9.4% |

-5.7% |

-4.2% |

-3.7% |

-1.6% |

na |

(1) RMC is the sum of sales from both fixed & site plants.

Figure 1. Building materials sales volumes in GB, quarterly percentage change (seasonally adjusted)

Ends.

For further information, please contact Robert McIlveen at robert.mcilveen@mineralproducts.org. Tel: 0207 963 8000.