The continuing decline in permitted reserves for essential primary aggregates will need to be addressed urgently to support the British economy over the next 15 years.

The continuing decline in permitted reserves for essential primary aggregates will need to be addressed urgently to support the British economy over the next 15 years.

That’s according to a new report from the Mineral Products Association (MPA) showing that around 4 billion tonnes of aggregates – crushed rock and sand & gravel – will be needed to meet the country’s construction needs.

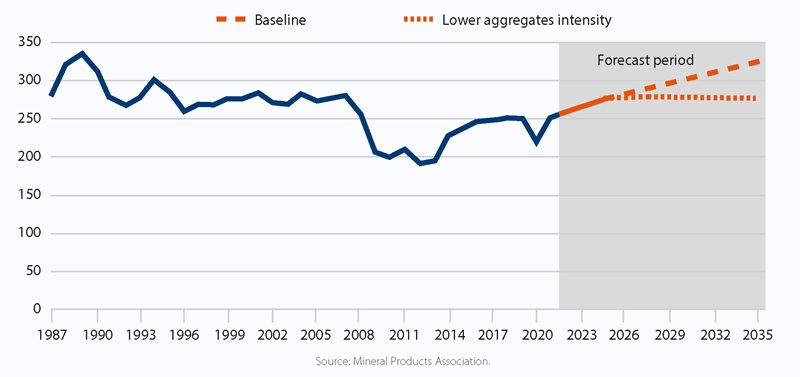

Demand projections for Great Britain suggest that, by 2035, some 277 to 323 million tonnes of aggregates will need to be supplied each year. Cumulatively, this means that between 3.8 and 4.1 billion tonnes of aggregates will be required between 2022 and 2035, compared to a total of 3.2 billion tonnes of aggregates supplied in the previous period, between 2008 and 2021.

In recent years, around 250 million tonnes of aggregates have been used each year in Great Britain, with 28% coming from recycled and secondary sources, close to the maximum achievable. In 2020, when the Covid-19 pandemic prompted a historic shock to UK construction, total aggregates demand still reached 220 million tonnes.

The report Aggregates demand and supply in Great Britain: Scenarios for 2035 highlights pressure points that may come to bear on some traditional sources of aggregates, through restricted availability and limited access to particular mineral resources.

This will require the wider portfolio of domestic aggregates supply to re-balance in order to ensure a steady and adequate supply of essential minerals to support the economy is maintained. A continuing decline in permissions for land-based sand & gravel in particular is likely to place increasing pressures on the supply of local aggregates over the next 15 years. It could mean greater dependence on larger crushed rock quarries, with more materials travelling greater distances, and increased reliance on marine sand & gravel. For the past decade, for every 100 tonnes of sand & gravel produced from permitted reserves, only 63 tonnes have been replaced through new planning permissions. For crushed rock, the replenishment rate is a little higher at 76%, although it mostly reflects new permissions granted at a small number of sites in 2011 and 2012, which means that the ten-year replenishment rate will reduce significantly in the next two years.

In its report, the MPA also expresses caution over the contribution from recycled and secondary aggregates to construction activity. While these sources will continue to provide a valuable supply of aggregates, the limited availability of secondary and recycled resources suggests the potential for these to significantly increase will be limited. Primary aggregates are therefore expected to continue to meet over two-thirds of overall demand for the next 15 years.

The future supply of aggregates faces additional challenges related to port and transport infrastructure – rail depots and marine wharves for loading and unloading – and access to skills.

Some of these issues will also limit the scope for an increase in imported tonnages to offset constraints in domestic production, which could only happen if commercially viable and environmentally sustainable. Even assuming a doubling of currently imported aggregates tonnages to 10 million tonnes per annum by 2035, this would still represent less than 5% of the total primary aggregates supply.

Given the foundation role that minerals and mineral products play in supporting economic activity, the MPA identifies a number of key issues that need to be addressed in order to maintain a steady and adequate supply of essential aggregates:

- Future availability and supply of essential minerals cannot be assumed; it needs to be planned, monitored and managed. In particular, there is a need for greater transparency of the construction material needs associated with nationally significant infrastructure projects and other major developments.

- A more strategic, long-term approach is required to inform the Managed Aggregates Supply System (MASS) and ensure a steady and adequate supply is enabled, whether nationally, regionally or locally. This would allow both the local mineral planning system and the mineral products industry to respond in a timely manner to ensure the right materials are available in the right place and at the right time – thus ensuring the most cost-effective and sustainable supply options can be provided.

- Permitted reserves of primary aggregates will need to be unlocked to ensure demand can be met, because imports, recycled and secondary materials cannot fill the anticipated gap and fulfil all the demands created by our future construction needs. Replenishment rates for sand & gravel in particular will need to increase, relying upon the industry bringing forward more planning applications and the mineral planning system responding appropriately.

MPA Chief Executive Nigel Jackson said: “Minerals and mineral products are the largest material flow in the national economy, with 400 million tonnes of essential resources and associated products being consumed every year. Aggregates are by far the largest component of supply the over-riding majority of these are derived from domestic sources – providing jobs and making a direct contribution to the economy, but also providing a foundation for wider economic activities.

“The next 15 years will see around 4 billion tonnes of aggregates required, and the availability and supply of these essential minerals cannot be assumed. Given the role minerals play in supporting the development of better energy and water facilities and activities, improved transport networks and regeneration of our towns and cities, their ongoing availability and supply needs to be treated as a strategic issue as mineral products are self evidently critical to national infrastructure, the economy and our quality of life.”

Total aggregates demand in Great Britain: 2022-35 projections under the baseline and lower aggregates intensity assumptions (million tonnes)

Ends.

About the Mineral Products Association:

The Mineral Products Association (MPA) is the trade association for the aggregates, asphalt, cement, concrete, dimension stone, lime, mortar and silica sand industries. With the merger of British Precast, and affiliation of the British Association of Reinforcement (BAR), the British Calcium Carbonate Federation, the Cement Admixtures Assocation (CAA), CONSTRUCT, Eurobitume, MPA Northern Ireland, MPA Scotland and the UK Quality Ash Association (UKQAA), it has a growing membership of 520 companies and is the sectoral voice for mineral products. MPA membership is made up of the vast majority of independent SME quarrying companies throughout the UK, as well as the 9 major international and global companies. It covers 100% of UK cement and lime production, 90% of GB aggregates production, 95% of asphalt and over 70% of ready-mixed concrete and precast concrete production. In 2018, the industry supplied £16 billion worth of materials and services to the Economy. It is also the largest supplier to the construction industry, which had annual output valued at £172 billion in 2018. Industry production represents the largest materials flow in the UK economy and is also one of the largest manufacturing sectors.

For media enquiries, contact Elizabeth Clements at: Elizabeth.Clements@mineralproducts.org