After a healthy first quarter of 2022 for UK producers of mineral products, the outlook for the rest of the year will be influenced by rising costs, lower growth prospects and international uncertainties, according to Mineral Products Association (MPA).

New MPA figures show that markets for essential materials like aggregates, concrete, asphalt and mortar continued where they left off at the end of 2021, with sales volumes increasing on a quarterly basis in 2022Q1. This reflects firm construction demand at the start of 2022 despite the bad weather that hit parts of Great Britain during February, and some easing in reported supply chain constraints, including for HGV drivers - albeit at a cost.

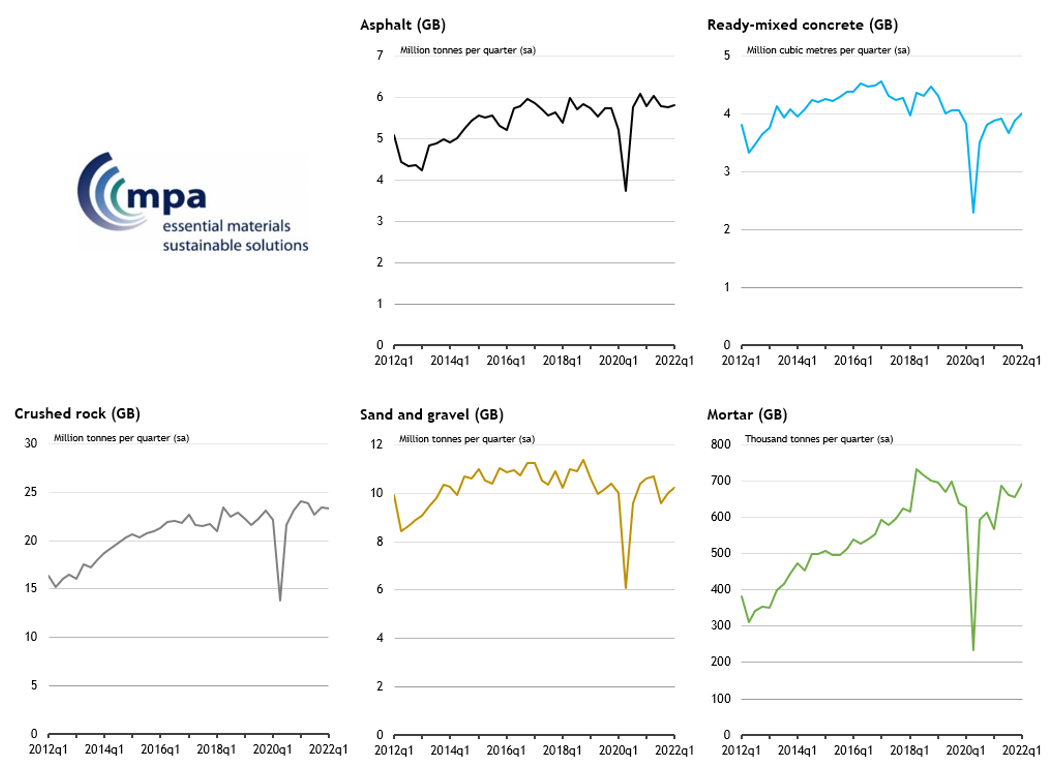

The latest industry survey from the Mineral Products Association (MPA) shows that asphalt sales volumes[1] in Great Britain rose by 1.0% in 2022Q1 compared to the previous quarter, sand & gravel by 2.1%, ready-mixed concrete by 3.2% and mortar by 5.5%. Only crushed rock volumes saw a marginal decline on a quarterly basis (-0.4%) but remain at an elevated historical level (see figure 1).

These materials are the essential ‘heavy-side’ elements of the construction supply chain, forming the foundations and structures of building projects and infrastructure schemes, with MPA members supplying over 90% of total market demand in Great Britain.

After hitting their highest peak since 2008 last year, asphalt volumes continue to be supported by pent-up demand from delayed road projects due to the pandemic, in addition to demand stemming from National Highway’s Road Investment Strategy (RIS2) and an increase in demand from local authorities’ repair and maintenance work. The bulk of the logistical and haulage issues reported by asphalt producers last year appear to have eased, but the cost of labour, energy and raw materials including bitumen, are all escalating. The big concern is the impact this may have on planned National Highways schemes and already stretched-out local authorities’ repair and maintenance budgets.

Ready-mixed concrete sales were hit hard during the onset of the pandemic, and in the year ending March 2022 were still 6% below the pre-pandemic (2019) levels. Both London and the South East, which make up just over 30% of the total share of volumes across Great Britain, have endured a sustained period of weakness which can be traced back to comparatively slow recovery in commercial construction projects, particularly for new office towers and retail space. Overall demand is nonetheless supported by major infrastructure projects, including HS2 and Hinckley Point C, as well as a healthy pipeline of industrial warehouse projects.

Simultaneously, a pick up in new housing starts since last summer is also fuelling increases in mortar demand. On a quarterly basis, mortar sales reversed the two back-to-back quarterly declines in the second half of 2021, with a 5.5% increase in 2022Q1. Sales volumes returned to their highest level since 2019Q3. However, while the current year has begun strongly, the uncertainties facing housebuilding have increased amid rising costs of materials and labour. The wider macroeconomic conditions are also being closely watched, particularly as the increasing cost of living has sparked a decline in confidence among UK households, and nudged the Bank of England to increase interest rates four times in less than five months, pushing up mortgage costs.

In the aggregates market, crushed rock sales remain comfortably above the pre-pandemic level, benefiting from demand from highways schemes and the manufacture of asphalt, and as fill materials on major infrastructure projects. Sand & gravel sales have been more muted, albeit this is linked to weaknesses in some areas of ready-mixed concrete demand.

The bulk of the momentum in mineral products demand recorded at the start of the year should carry over into Q2, but thereafter, Aurelie Delannoy, MPA Director of Economic Affairs, warns that steep cost increases and broadening risks facing the UK economy could make for a more challenging environment over the second half of the year and into next year.

“Current construction activity levels and mineral products demand remain high. The short-term pipeline is also robust. However, with material cost inflation running at 25% on an annual basis in April, the supply environment is a challenge. There are concerns over the impact of passing these costs onto customers and the commercial viability of future projects.”

“We expect that large infrastructure projects will continue to drive further growth in demand but this cannot be at the expense of the ‘bread and butter’ activity level fuelled by the private sector, particularly consumer-facing private new housing, private housing repair and maintenance and commercial retail sectors. Construction forecasters have already reduced their growth expectations for this year and there are signs that the pressures are continuing to pile up. This means that mineral products companies are facing a tough combination of rising costs, dwindling growth prospects and international uncertainties.

“Confidence to invest in future capacity to deliver on Government’s increased infrastructure and housing ambitions relies on better delivery of planned projects than has been evident in recent years. Meanwhile, two energy intensive mineral products industries - cement and lime – have been excluded from Government’s compensation scheme for climate change costs on the basis of technicalities. Clearly, a more consistent and strategic approach to Government’s objectives and policy delivery is still lacking.”

Figure 1. Mineral products sales volumes in Great Britain

Table 1. MPA sales volumes in GB: change on the previous period (seasonally adjusted)

|

|

Asphalt

|

Ready-mixed concrete*

|

Crushed rock

|

Sand & Gravel

|

Mortar

|

|

2019

|

-0.8%

|

-3.9%

|

-0.7%

|

-5.4%

|

-2.3%

|

|

2020

|

-8.6%

|

-18.2%

|

-9.6%

|

-12.4%

|

-23.5%

|

|

2021

|

12.5%

|

14.1%

|

16.7%

|

13.3%

|

24.4%

|

|

|

|

|

|

|

|

|

2021Q2

|

4.5%

|

1.2%

|

-0.9%

|

0.9%

|

21.2%

|

|

2021Q3

|

-4.2%

|

-6.4%

|

-4.6%

|

-10.4%

|

-3.8%

|

|

2021Q4

|

-0.3%

|

5.5%

|

3.2%

|

4.5%

|

-0.7%

|

|

2022Q1

|

1.0%

|

3.2%

|

-0.4%

|

2.1%

|

5.5%

|

|

|

|

|

|

|

|

|

4 quarters to 2022Q1 vs. 2019

|

2.9%

|

-5.9%

|

4.8%

|

-1.7%

|

-0.1%

|

* Ready-mixed concrete sales volumes at GB level cover sales from both fixed and site (mobile) plants.

Source: MPA, ONS.

Ends.

About the Mineral Products Association:

The Mineral Products Association (MPA) is the trade association for the aggregates, asphalt, cement, concrete, dimension stone, lime, mortar and silica sand industries. With the merger of British Precast, and affiliation of the British Association of Reinforcement (BAR), the British Calcium Carbonate Federation, the Cement Admixtures Assocation (CAA), CONSTRUCT, Eurobitume, MPA Northern Ireland, MPA Scotland and the UK Quality Ash Association (UKQAA), it has a growing membership of 520 companies and is the sectoral voice for mineral products. MPA membership is made up of the vast majority of independent SME quarrying companies throughout the UK, as well as the 9 major international and global companies. It covers 100% of UK cement and lime production, 90% of GB aggregates production, 95% of asphalt and over 70% of ready-mixed concrete and precast concrete production. In 2018, the industry supplied £16 billion worth of materials and services to the Economy. It is also the largest supplier to the construction industry, which had annual output valued at £172 billion in 2018. Industry production represents the largest materials flow in the UK economy and is also one of the largest manufacturing sectors.

For media enquiries, contact Elizabeth Clements at: Elizabeth.Clements@mineralproducts.org.

[1] Data are seasonally adjusted.