Delivered volumes of heavyside mineral products broke records in the second quarter of 2021 pointing to robust construction and manufacturing activity despite reports of material and staff shortages.

The latest quarterly survey from the Mineral Products Association (MPA) shows that in recent months the industry has supplied the highest quarterly volumes of materials such as aggregates and asphalt in more than 12 years.

MPA believes this strong growth in material demand shows that recovery in construction is intensifying, despite ONS data suggesting that construction output slowed in April and May. And since heavyside materials tend to be used early in building projects – for foundations and core structures – the figures suggest that construction will remain buoyant for at least the next few months.

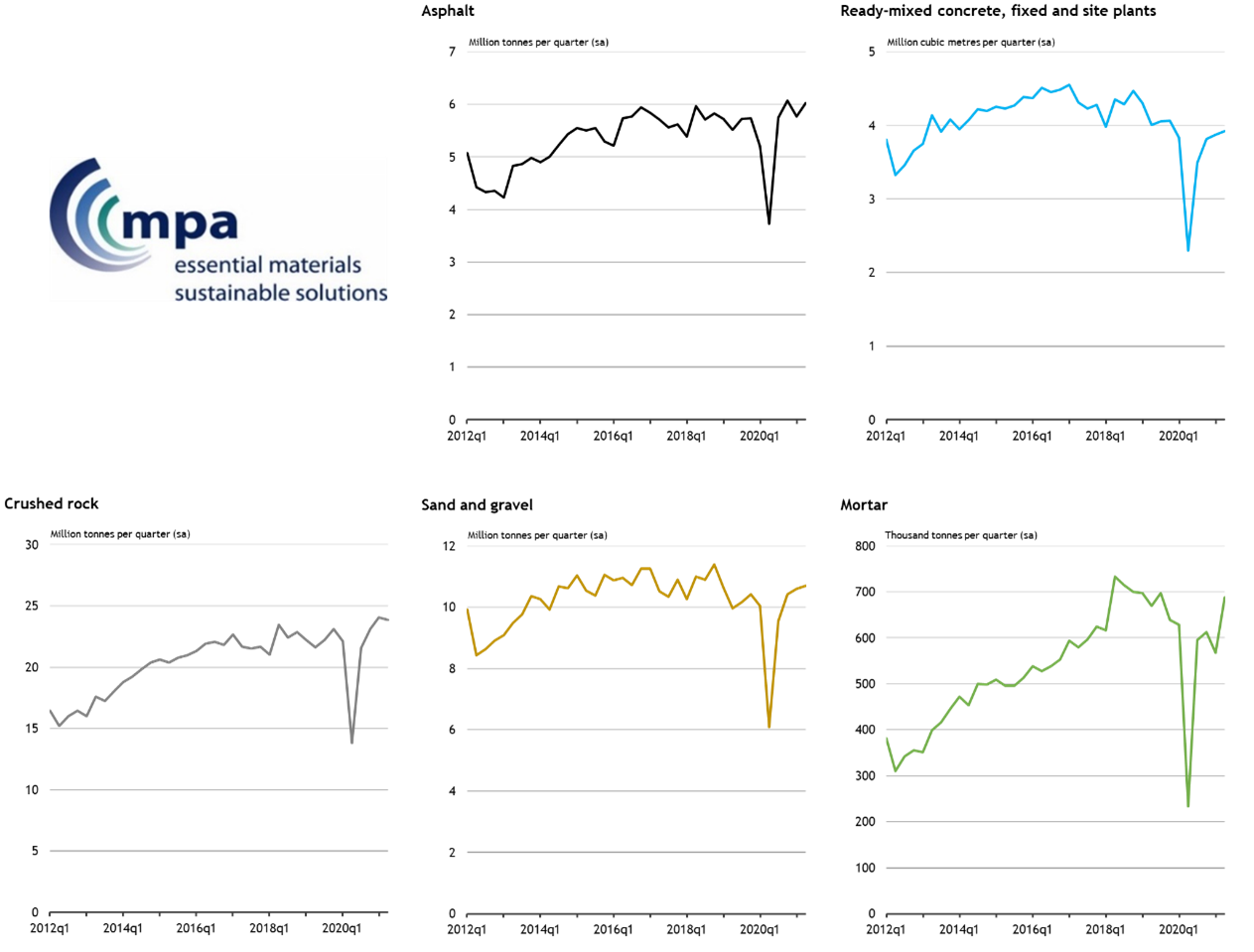

For aggregates, although sales of primary crushed rock, sand and gravel recorded a small decline of 0.4% in 2021 Q2 compared to Q1, the first half of 2021 saw aggregates sales volumes at their highest since mid-2008. Aggregates sales have recovered rapidly in the past year, boosted by demand for bulk fill materials on major infrastructure projects and highway schemes.

Asphalt sales volumes rose by 4.5% on a quarterly basis in 2021 Q2 to over 6 million tonnes, the second highest volume recorded since 2008 (the highest was in 2020 Q4). Pent-up demand from delayed roads projects due to the pandemic, wider progress on the delivery of Government’s road investment strategy, and an increase in demand from local authorities for repair and maintenance work, all resulted in an unexpectedly rapid recovery in activity. Total demand for asphalt in the year to June 2021 was 4.0% higher than in 2019, with demand particularly strong in Scotland and the East Midlands.

In mortar sales, which closely reflects housebuilding activity, volumes rose at their second fastest quarterly rate of growth since 2012, up by 21.2%, although some of that is likely to be a ‘catch-up’ from the impact of adverse weather at the start of the year. Growing momentum in mortar sales is evidence of new housebuilding activity starting, rather than the completion of existing developments. This indicates a renewed pipeline of work for other sectors of the construction supply chain over the next few months.

By contrast, market conditions for ready-mixed concrete remain weak. Concrete sales volumes increased by 1.2% from Q1 to Q2 but a comparatively slow recovery since last year means that volumes on an annual basis are significantly down compared to 2019, particular in London and the South East. Demand from industrial projects is strong, with the building of new distribution centres for online retailers. The biggest driver of activity is infrastructure, especially with work increasing on HS2. On the other hand, demand from office and retail developments is weak as the sector is still coping with the cumulative effects of four years of Brexit-related uncertainty, compounded by the ongoing impact of the pandemic.

MPA anticipates that demand for core construction materials will remain high for the remainder of this year and into 2022. The outlook for construction, and in particular infrastructure, is expected to drive double-digit growth in mineral products sales through 2021 with further, albeit more muted, growth in 2022.

Aurelie Delannoy, MPA Director of Economic Affairs, said that pressures felt in other sectors of the economy were also impacting mineral products manufacturers: “The surge in pent-up demand for materials in recent months, plus declining availability of haulage drivers as well as increasing costs are causing concerns over future supply capacity, although every effort is being made to mitigate these. Despite challenging circumstances, companies supplying mineral products have on the whole continued to meet the demands, delivering record volumes along the way.”

Nigel Jackson, MPA Chief Executive said: “The mineral products sector has performed valiantly over the first half of 2021 in spite of all the challenges and uncertainties, the currently avoidable ‘pingdemic’ being but one. There has been much talk about ‘what has not been supplied’, for example bagged cement in some areas, but this really needs to be seen in perspective - the vast majority of this year’s unprecedented demand for materials has been met. The issue has been more about keeping up with excess demand at a time when seasonal stocks are usually low whilst scheduled plant maintenance normally planned for quieter periods was out of ‘sync’ with the sudden surge in activity.

“Bear in mind we’re an industry that typically supplies a million tonnes of materials every day so there are bound to be a few strains in the supply chain. Eventually the collision between increased material demand, a perpetually under-resourced mineral planning system and under-replenished mineral reserves will hit home. Sooner or later this will have to be addressed and with far more innovative thinking than we’ve seen with the latest review of the planning bill, which will do nothing to help the country sustain a supply of essential mineral products.”

Figure 1. Mineral products sales volumes in Great Britain

Table 1. MPA sales volumes in GB: change on the previous period (seasonally adjusted)

|

|

Asphalt

|

Ready-mixed concrete*

|

Crushed rock

|

Sand & Gravel

|

Mortar

|

|

2018

|

0.7%

|

-1.6%

|

2.5%

|

1.3%

|

15.6%

|

|

2019

|

-0.8%

|

-3.9%

|

-0.7%

|

-5.4%

|

-2.3%

|

|

2020

|

-8.6%

|

-18.2%

|

-9.6%

|

-12.4%

|

-23.5%

|

|

|

|

|

|

|

|

|

2020Q2

|

-28.3%

|

-40.0%

|

-37.6%

|

-39.4%

|

-63.0%

|

|

2020Q3

|

54.4%

|

52.0%

|

56.1%

|

56.6%

|

155.3%

|

|

2020Q4

|

5.5%

|

9.1%

|

7.3%

|

9.1%

|

3.1%

|

|

2021Q1

|

-4.9%

|

1.6%

|

4.1%

|

1.9%

|

-7.4%

|

|

2021Q2

|

4.5%

|

1.2%

|

-0.9%

|

0.9%

|

21.2%

|

|

|

|

|

|

|

|

|

4Q to 2021Q2

vs. 2019

|

4.0%

|

-8.0%

|

3.9%

|

0.1%

|

-8.9%

|

Note: Ready-mixed concrete includes sales from both fixed and site (mobile) plants.

Source: MPA.

Ends.

About the Mineral Products Association:

The Mineral Products Association (MPA) is the trade association for the aggregates, asphalt, cement, concrete, dimension stone, lime, mortar and silica sand industries. With the merger of British Precast, and affiliation of the British Association of Reinforcement (BAR), Eurobitume, MPA Northern Ireland, MPA Scotland and the British Calcium Carbonate Federation, it has a growing membership of 520 companies and is the sectoral voice for mineral products. MPA membership is made up of the vast majority of independent SME quarrying companies throughout the UK, as well as the 9 major international and global companies. It covers 100% of UK cement and lime production, 90% of GB aggregates production, 95% of asphalt and over 70% of ready-mixed concrete and precast concrete production. In 2018, the industry supplied £16 billion worth of materials and services to the Economy. It is also the largest supplier to the construction industry, which had annual output valued at £172 billion in 2018. Industry production represents the largest materials flow in the UK economy and is also one of the largest manufacturing sectors.

www.mineralproducts.org.

For media enquiries, contact Elizabeth Clements at: Elizabeth.Clements@mineralproducts.org ; tel: 07775 894 285