- Sector under severe strain after four consecutive years of decline

- Urgent action needed to support British industry and protect British jobs

New data shows that sales of heavy-side construction materials in Britain remain at ‘crisis levels’ with businesses in peril, jobs at risk and little sign of recovery.

New data shows that sales of heavy-side construction materials in Britain remain at ‘crisis levels’ with businesses in peril, jobs at risk and little sign of recovery.

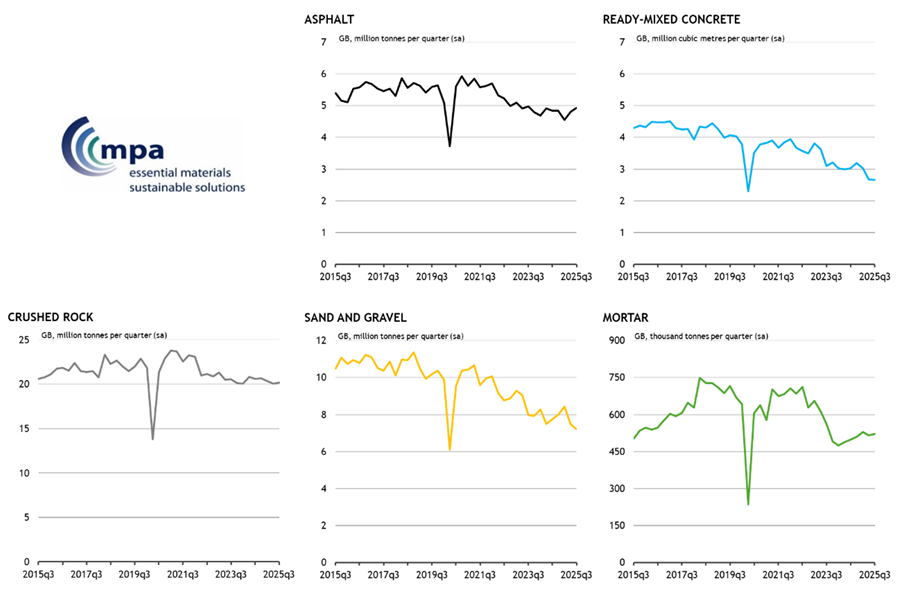

The sobering third quarter (Q3) figures from the Mineral Products Association (MPA) reveal continued weakness in aggregates, concrete and asphalt sales, laying bare a faltering construction sector and the fragile state of the UK economy.

The MPA’s survey — using actual sales volume data from its members — is a stark warning that the Government needs to put business first in the Autumn Budget, to restore confidence, encourage investment and support British jobs through the urgent delivery of infrastructure and housing in line with its manifesto pledges.

Ready-mixed concrete sales, a barometer for overall construction activity, fell by a further 0.8% in Q3 compared with Q2 and were 12% lower than a year earlier, extending a prolonged period of decline, with sales having fallen in seven of the past eight years. Aggregates sales were broadly flat while asphalt volumes rose slightly (+2.5%) though sales this year remain below 2024 levels. Although mortar sales improved slightly (+1.0% this quarter) this should be set against a 30% drop over two years in 2023-4.

Regionally, the biggest hit has been taken by the London market, with concrete volumes down by a whopping third (-32%) over the past year, a sharper fall than anywhere else in Great Britain. This desperate situation mirrors wider evidence of London’s housing slowdown, with steep declines in approvals, starts and completions, with one key factor being the capital’s exposure to delays on new high-rise buildings caused by planning bottlenecks at the Building Safety Regulator (BSR).

Across the country, weak housebuilding and commercial construction continue to drag heavily on activity, offset only partly by ongoing infrastructure work. There are only weak signs of recovery in the housing market, which is being held back by affordability pressures, weak buyer confidence and planning delays, including at the BSR. New commercial development remains subdued amid high financing costs and rock-bottom investor confidence. Together, these two sectors account for around half of total demand for concrete.

Even in major infrastructure the momentum has faded. HS2’s demand for high volumes of material have been cut back following the project reset, and no fewer than nine large scale road schemes have been cancelled in the past year, slashing the near-term demand for mineral products.

MPA warns that the sector, which employs more than 80,000 people, remains under severe strain after four consecutive years of declining sales. Businesses have shifted focus on to cost control and efficiency, with sites being mothballed, capacity reduced and skilled workers losing their jobs. These pressures threaten the longer-term supply resilience of essential materials, potentially undermining future housing and infrastructure delivery.

Aurelie Delannoy, MPA Director of Economic Affairs said: “The latest data show that the construction downturn remains entrenched. The mineral products sector is having to operate at crisis levels, with no prospect of recovery in the near term. Construction materials are among the earliest indicators of real activity, and these figures send a clear warning to Government ahead of the Autumn Budget: the UK needs decisive measures to unlock project delivery, rebuild confidence and get growth moving.”

Chris Leese, MPA Executive Chair, added: “Announcements about infrastructure and planning are all well and good, but for now they remain promises of ‘jam tomorrow’. They do nothing to address the collapse in demand that is draining jobs and capacity from our sector. Without urgent action that results in work on the ground now, the foundations of future delivery — the business investment, the production capacity and the skilled workforce — may not be there at sufficient scale when the country needs them.”

In its Autumn Budget 2025 submission and follow-up letter to Chancellor Rachel Reeves, MPA has urged the Chancellor to avoid further business taxes and adopt a package of pro-growth measures. These include a super-deduction to boost investment in new plant and machinery, action to improve infrastructure delivery and local road maintenance, recovering the momentum on housebuilding, sustained support for carbon capture and measures to mitigate high energy costs, and greater use of public procurement to support British industry and jobs.

Figure 1. Mineral products sales volumes in Great Britain

Table 1. MPA sales volumes in GB: change on the previous period (seasonally adjusted)

|

|

Asphalt

|

Ready-mixed concrete*

|

Crushed rock

|

Sand & Gravel

|

Mortar

|

|

2022

|

-6.4%

|

-3.7%

|

-7.7%

|

-9.2%

|

3.5%

|

|

2023

|

-6.9%

|

-6.5%

|

-4.2%

|

-7.2%

|

-15.0%

|

|

2024

|

-2.5%

|

-10.9%

|

-0.4%

|

-7.9%

|

-15.0%

|

|

|

|

2024Q4

|

0.2%

|

5.4%

|

0.1%

|

2.9%

|

2.4%

|

|

2025Q1

|

-6.0%

|

-5.3%

|

-1.5%

|

5.5%

|

3.6%

|

|

2025Q2

|

5.5%

|

-11.4%

|

-1.4%

|

-11.4%

|

-2.5%

|

|

2025Q3

|

2.5%

|

-0.8%

|

0.7%

|

-3.3%

|

1.0%

|

Ends.

About the Mineral Products Association:

The Mineral Products Association (MPA) is the trade association for the aggregates, asphalt, cement, concrete, dimension stone, lime, mortar and industrial sand industries. MPA is the sectoral voice for mineral products, covering 100% of UK cement and lime production, 90% of GB aggregates production, 95% of asphalt and over 60% of ready-mixed concrete and precast concrete production. In 2021, the industry supplied £22 billion worth of materials and services to the Economy. It is also the largest supplier to the construction industry, which had annual output valued at £178 billion. Industry production represents the largest flow of materials in the UK economy and is also one of the largest manufacturing sectors.

For media enquiries, contact Robert McIlveen at: Robert.McIlveen@mineralproducts.org