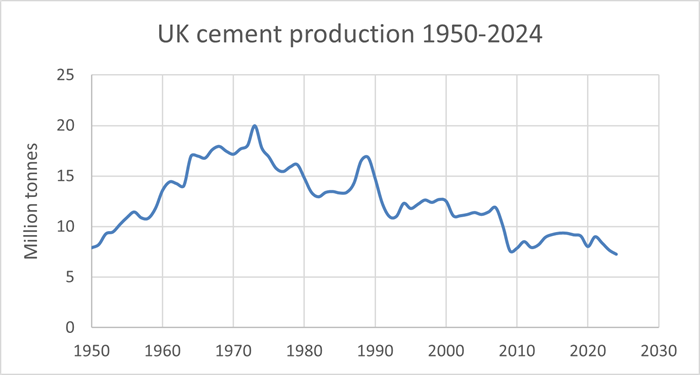

- UK cement production has dropped to lowest point since 1950 when wartime rationing was still in place and King George VI was on the throne

- Industrial decline jeopardises the government’s housebuilding and infrastructure delivery targets

- The domestic cement sector is calling for ongoing action on high electricity prices, a watertight CBAM to level the playing field with imports, and policy support on CCUS to continue decarbonisation progress

UK cement production has hit its lowest level since 1950 as high energy, regulatory and labour costs stifle the sector’s competitiveness, according to new data from the Mineral Products Association (MPA). The UK made 7.3 million tonnes of cement in 2024, around half of what it produced in 1990.

It follows recent MPA data showing ready-mix concrete sales hit historic lows in the second quarter of 2025, with other materials also down on the previous year.

The drop in cement production puts Labour’s housebuilding and infrastructure plans at risk. Cement is a main ingredient in concrete, the world’s most used construction material, making it vital for building foundations and structures. Up to 750,000 tonnes of cement could be required for a project like Sizewell C and nearly 8,000 tonnes for a new hospital, while between 3-5 tonnes are needed to construct a traditional four-bedroom family house.

Cement imports to the UK have nearly tripled over the past 20 years, rising from 12% of all sales in 2008 to 32% in 2024. This leaves construction supply chains increasingly exposed to the risks of volatile international markets. Around 40% of UK cement is made in the Peak District, while the remaining 60% is spread across all four nations of the UK, providing well-paid, productive jobs. However, as imports rise, there is a risk that domestic jobs could disappear in the future.

The UK’s cement manufacturers are battling some of the highest industrial electricity prices among developed nations and uneven carbon taxation, which means importers – especially those outside of the EU – don’t pay the same costs for their emissions. The UK’s Carbon Border Adjustment Mechanism is intended to address this from 2027, but it needs to be supported with a procurement policy that prioritises domestically produced materials.

Dr Diana Casey, executive director for cement and lime at the Mineral Products Association, said: “Cement is an essential industry, but the sector is increasingly under threat. We’re calling on the government to help put domestic production on a level playing field so that it can compete fairly with imports.

“Cement quite literally underpins the nation’s growth and we can’t deliver new homes, schools, hospitals, transport links or clean energy infrastructure without it. The UK has a choice: to build these vital development projects with UK-made cement, or to build them with imports – sending jobs, investment and economic growth overseas.”

ENDS

Notes for editors:

For more information about the UK cement sector, please visit: https://mpa-cement.uk/

About the Mineral Products Association:

The Mineral Products Association (MPA) is the trade association for the aggregates, asphalt, cement, concrete, dimension stone, lime, mortar and industrial sand industries. MPA is the sectoral voice for mineral products, covering 100% of UK cement and lime production, 90% of GB aggregates production, 95% of asphalt and over 60% of ready-mixed concrete and precast concrete production. In 2021, the industry supplied £22 billion worth of materials and services to the Economy. It is also the largest supplier to the construction industry, which had annual output valued at £178 billion. Industry production represents the largest flow of materials in the UK economy and is also one of the largest manufacturing sectors.

For media enquiries, contact Camargue: cement@camargue.uk / 0207 636 7366